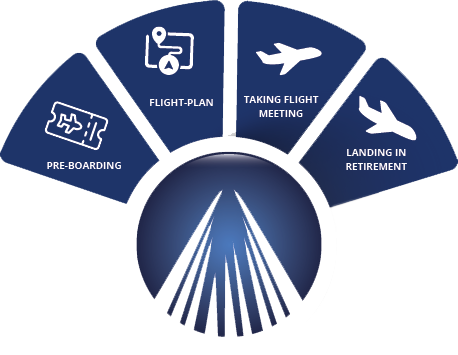

We take financial planning to new heights. Whether you need a completely new financial plan or are unhappy with your current one, we are the right firm to create your retirement flight plan. We create a visual plan for you and your family using the latest financial planning software. Please don't take our word for it. Let us prove it to you.

The aviation industry has a guideline known as the 60-to-1 rule.

This rule explains that if you’re one degree off your designated course, you will miss your target landing spot by 92 feet for every mile you travel. For every 60 miles you travel you will miss your landing by one mile. The longer you travel, the further off course you will be.

This is why we modeled our financial planning off the aviation industry. We want to identify if you are off track with your retirement and make the appropriate changes as soon as possible to get you back on course.

Time for TakeOff

Ready to take flight and land comfortably in retirement?

Let's make history.

Contact us today to discuss how we can take your retirement to new heights.